Carried Interest & Co-Investment

EWM’s carried interest and co-investment plan admin capabilities provides Finance teams with the latest tools to efficiently manage the end-to-end plan lifecycle for bespoke incentive programs. Our summary page gives participants a clear, on demand, one page view of their total exposure and returns in all funds they participate.

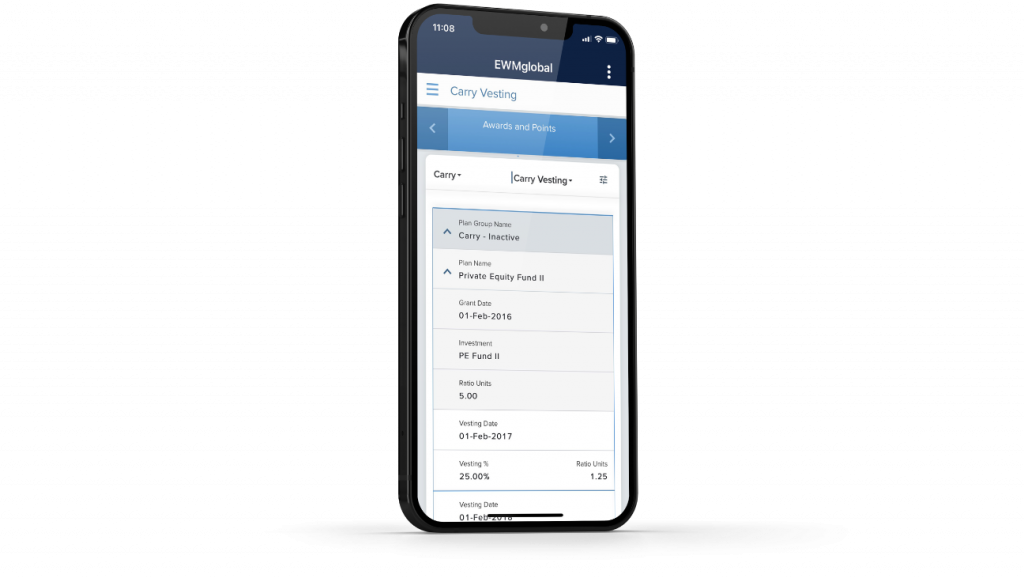

Carried Interest

Participants can view each set of points granted to them within their programs along with the respective vesting calendars for those points.

Carry Transactions

- System automated split of carry events based on GP allocation via front end UI and data load

- GP level transaction posting via data load

- Customized netting groups for calculation of payouts from available cash

Carry Point Allocation

- Allows for any point pool at the fund, investment or vintage year

- System validations maintain pool size for all reallocations and forfeitures

- Unique vesting down to the individual grant level

- Multi-account split functionality

Co-Investment

Track the full lifecycle of co-investment programs, including:

- Capital calls

- Leverage allocations

- Leverage interest payable

- Distributions

- Unrealised gain/loss

- Performance metrics and transactions at fund and/or deal level

Our GP co-investment platform digitally transforms the participant and sponsor experience for plans where firm members must or can participate alongside the firm’s investors – either with or without firm-provided leverage – giving them a clear understanding of their investment performance.