Perception: voluntary deferred compensation (“VDC”) plans don’t work outside the US

In our conversations with US multinational companies sponsoring VDC plans for their domestic employees and with tax/legal advisors to such firms, we frequently hear that an effective voluntary deferral of compensation is not possible anywhere other than in the US.

Such statements are surprising and misguided. For the past 17 years, EWM Global has been administering global VDC plans, covering employees in the UK and other non-US jurisdictions. Prior to that, its principals were participants in such plans.

Therefore we recently refreshed our knowledge to identify those countries other than the US in which it is currently possible for plan sponsors to offer, and for eligible participants to participate in, a VDC plan.

Reality: they do, but in a limited number of countries

Our research indicates that VDC plans would be viable and economically beneficial in Australia, Belgium, Brazil, Canada, Germany, Sweden and the UK.

In each of these countries, there is sufficient taxation of investment gains to deliver an attractive net financial benefit from deferring compensation and the tax rules permit voluntary deferral by the employee with no imposition of risk of forfeiture. Note however that in Canada the deferral period is limited to three years. And in Belgium and Sweden, VDC plans are not common and could be subject to a challenge by the tax authorities, a risk that could be mitigated by requesting authorization for a VDC plan.

Most of the other countries permit deferral if there is “substantial risk of forfeiture” related to employment status, which is why mandatory deferral plans can operate far more widely than VDC plans.

Approach to the analysis

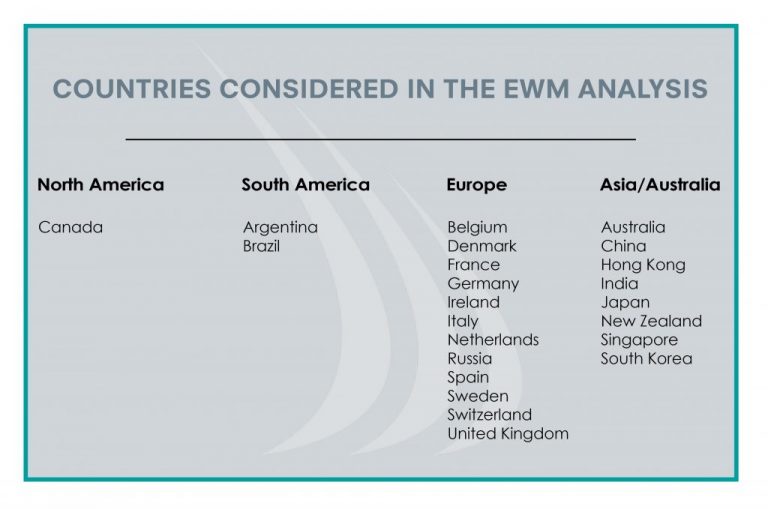

We first narrowed the scope of the analysis by considering most developed countries and major developing countries around the world, resulting in 23 jurisdictions:

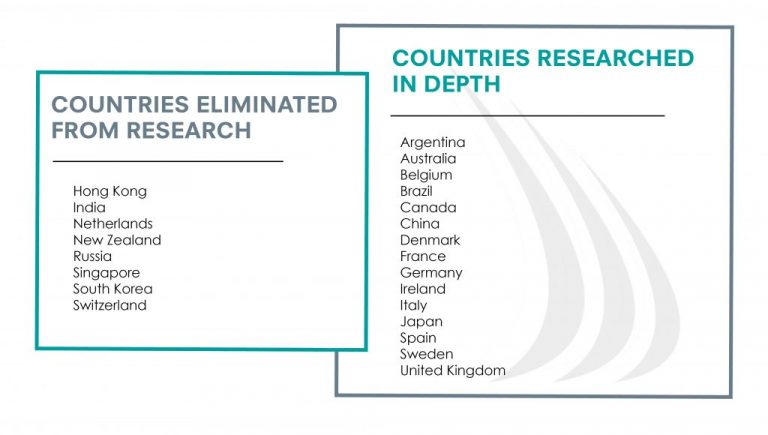

Next we reviewed each country’s tax regime applicable to capital gains, dividends and interest, eliminating those jurisdictions where such taxes are very low (10% or less) or zero (implying little or no financial benefit from pre-tax compensation deferral), leaving us with the task of researching the tax legislation concerning voluntary deferrals of compensation in 15 countries:

This task was conducted with the help of Deloitte who researched, and provided detailed information about, the feasibility of an effective pre-tax deferral in most of these jurisdictions. The result is a short list of six countries:

Implications for multinational VDC plan sponsors

Multinational plan sponsors can offer a common VDC plan to their key employees working in countries other than the US. In the six countries identified above, participating employees can achieve the same or similar benefits as their US peers do.

In our experience, plan sponsors with multinational plans do offer them to employees in other countries as well to give them access to the investments offered within the plan on an after-tax basis.

The key challenges are administrative:

- Tailoring how the plan is offered and presented to eligible participants, and implemented, to comply with local regulations (e.g.: in Canada, the maximum permitted deferral period is three years; in the UK, the language is different, using the term “waiver” instead of “deferral”.

- Allowing participants in different countries to have their accounts denominated in their pay currency (and not in USD).

- Offering different selections of investments to participants in different countries (e.g.: focused on local/regional markets and denominated in their local currency).

- Translation of screen language and plan documents (not always necessary).

These challenges are easily met with the right plan design and administration capability.

At EWM Global, we administer VDC and other Non-Qualified Deferred Compensation plans that are offered in over 80 countries for global firms. We know first-hand that the benefit of VDC plans is available and worthwhile offering to employees of multinational companies outside the US. If you would like to learn more please contact marketing@ewmglobal.com.

The material above has been prepared for informational purposes only, and should not be considered advice for any individual and/or entity. Neither EWM Global nor any of its employees are in the business of providing tax, legal or accounting advice. We strongly recommend you seek the guidance of professional counsel to address your unique circumstances.