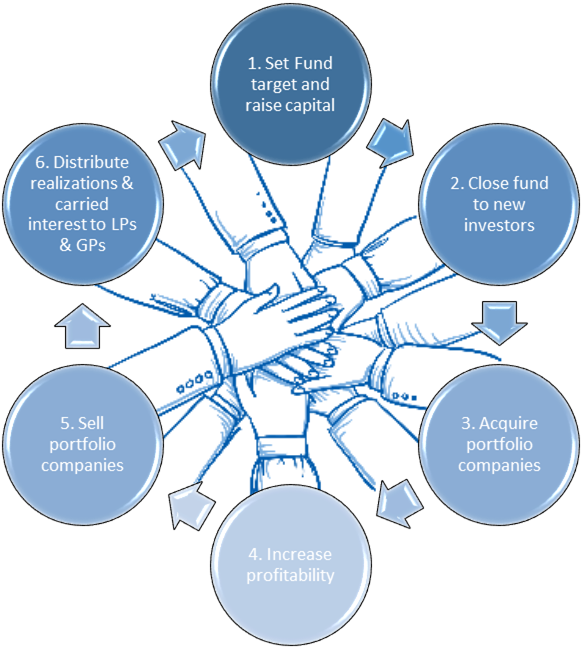

As far as one can remember, the standard private equity “holding period” – the time between buying and selling a portfolio company – typically averaged between 5 and 7 years, and followed the capital raising to distribution cycle adopted by almost any firm that invested in the private capital space.

However, in the past 12 – 18 months, some of the biggest names in private equity, including Apollo Global Management, Carlyle Group, KKR, and CVC Capital Partners, have either launched or announced plans to launch “long-hold” vehicles, with target holding periods of close to 10 – 15 years1. In their September 2018 first-half results presentation, Partners Group executive chairman Steffen Meister announced that they too would be joining that list2.

Research from Bain & Company’s Global Private Equity Report 20183 suggests that over a 24 month period, long-hold private equity funds could deliver double the post-tax investment multiple compared to standard funds. The report also listed additional compelling reasons why longer holding periods are attractive to both GPs and LPs, including investors gaining some ownership in the General Partner, instead of becoming another Limited Partner.

These two trends – longer investment horizons and investor-ownership of the GP – raise some interesting challenges for the Finance and HR teams at the General Partner. High on that list will be how to motivate investment team members of all ranks over the long(er) haul.

Carried Interest remains the primary mode of compensation for the mid to senior-most partners at Private Equity firms, and depending on the fund structure, could be paid either at:

- Fund level – carry paid on all investments in the fund

- Vintage level – carry paid on any investments made in a particular year

- Deal-by-deal level – carry paid on individual investments as they are realized

For the employees that don’t receive carried interest directly, they sometimes participate in a “phantom carry” plan, allowing them to share in the success of the firm.

Either way, more often than not, calculating and communicating carried interest tends to be a process manually managed on spreadsheets by a team of 1 or 2 individuals within the GP finance team.

This outdated and non-scalable approach becomes increasingly prone to errors and risks as the number of funds and size of the team increase. Add to that list the potential for longer durations of unrealized value that needs to be tracked, additions and departures from the team and the associated impact on carry point forfeitures and reallocations, and to top it all, the “institutional” investor-owners that will demand stronger reporting on carry at the GP level.

When investment team members don’t have a clear understanding of their compensation – they will leave.

There is a better way – one that gives your team members 24/7 access to their carry points, value and vesting in a secure, private cloud-based environment, while streamlining the process and mitigating the risks for the GP finance and HR teams.

Contact us to find out how EWM Global has modernized the carry plan experience for PE firms with over $500 billion in invested capital.

1. https://www.privateequityinternational.com/trends-of-the-year-long-term-funds/

2. https://www.partnersgroup.com/en/shareholders/investor-presentation/

3. https://go.bain.com/global-private-equity-report-2018.html