Deferred Cash

We recognize that deferred cash plans can only be effective if participants have a clear understanding of the wealth it allows them to generate over the deferral time-frame. Our platform can administer deferred cash plans that fit our clients’ specific and unique needs, providing participants with 24/7 access to their awards, vesting and balances, while offering plan sponsors robust administrative and reporting tools.

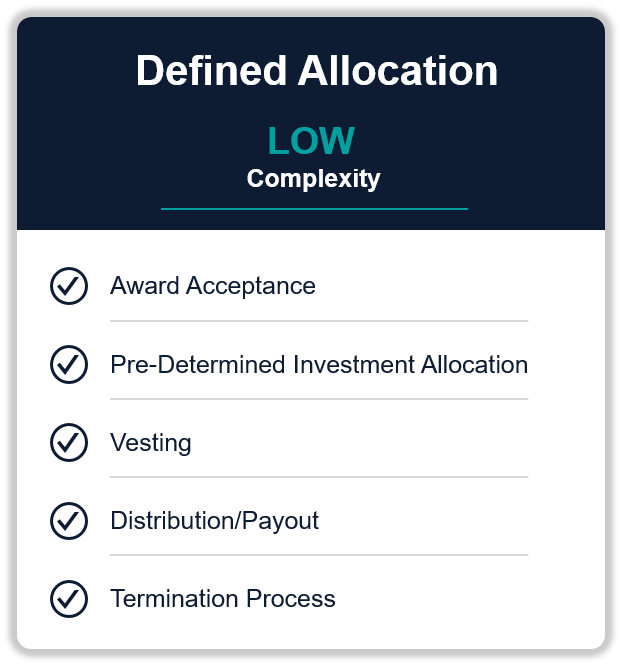

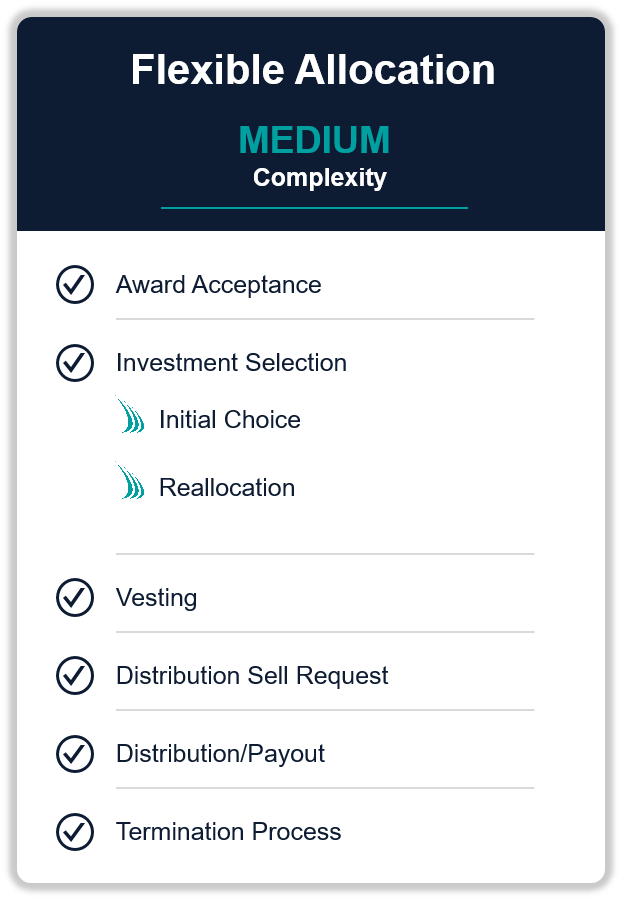

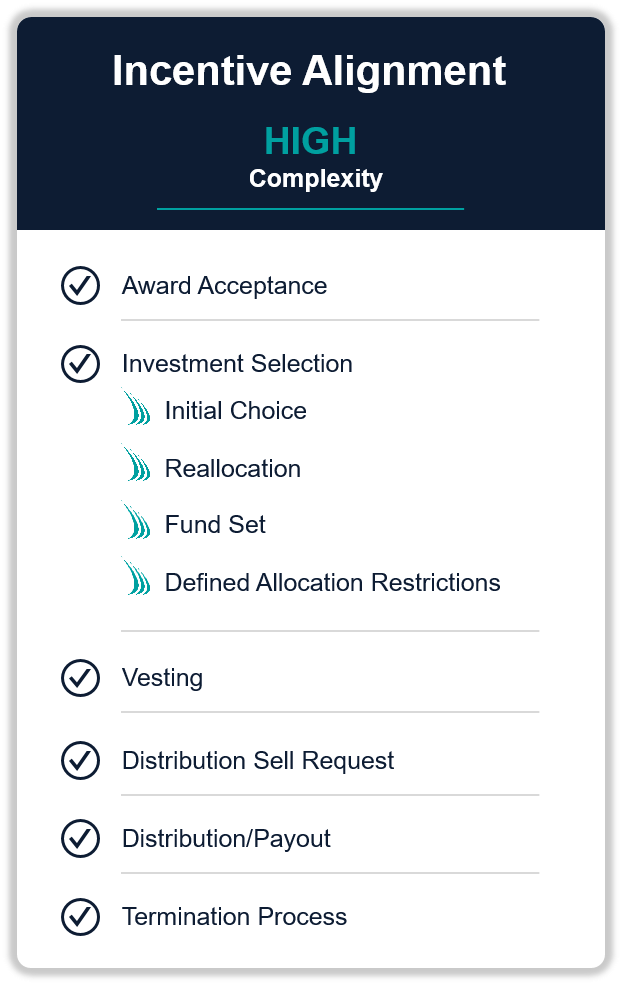

Deferred Cash Plan Comparison

Deferred Cash Plan Administration

Defined Allocation

The employer has pre-determined the funds in which the participants must invest. The participant is not allowed to choose where they want to invest their award.

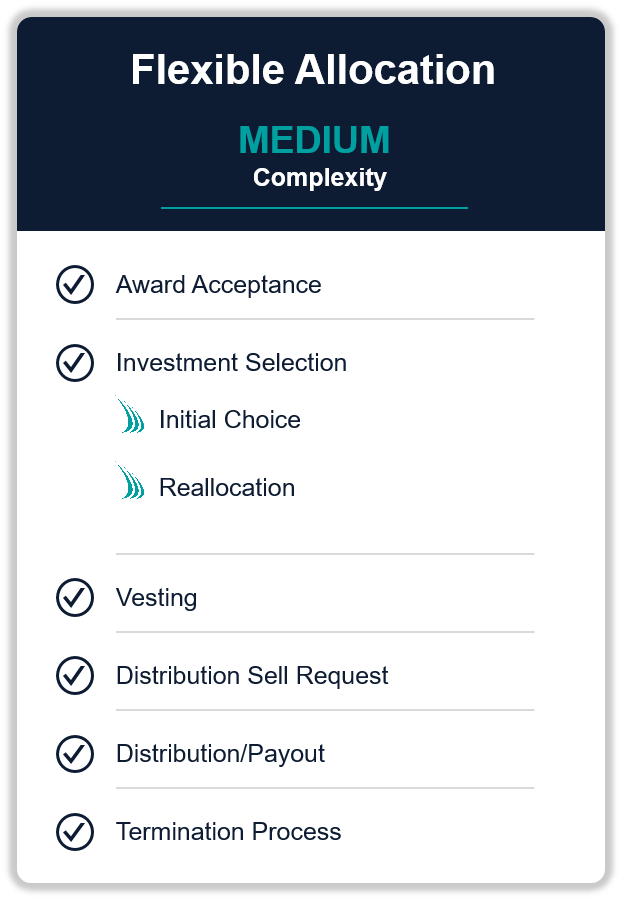

Flexible Allocation

The participant has the option to invest their award in one, all, or a portion of the approved funds chosen by their employer.

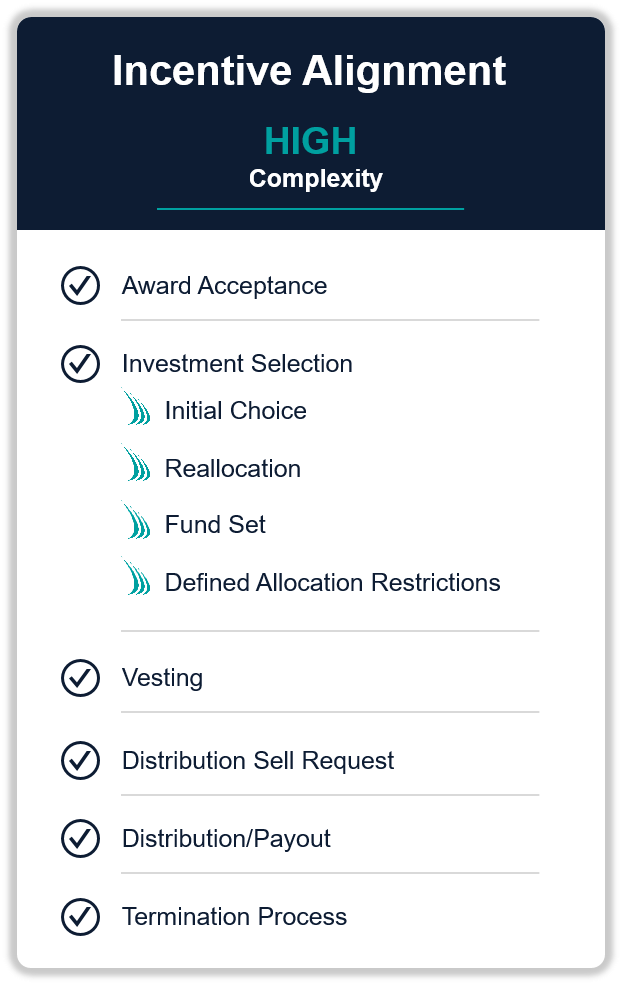

Incentive Alignment

The participant must invest a pre-determined percentage of their award in fund(s) they manage or hold a key role. The remaining percentage,if the incentive alignment is not 100%, can be a mixture of the approved funds the employer allows for investment.