Written by Rob Hagmeier

Published: December 2019/January 2020 Edition of PEI's Private Fund Management Magazine.

An anniversary date model can secure timely payments – and need not generate excessive complexity.

Amid the unprecedented growth in private markets and the increasingly competitive environment over the past decade, firms have become experts in finding ways to generate maximum value from their investment strategies. Rewarded based on the ability to identify and deliver optimal returns, carried interest remains the industry’s gold standard employee incentive and shows no sign of losing favor anytime soon.

Given the amount of money derived from carried interest, it is not surprising that the mechanics of the calculation have come under scrutiny from LPs seeking transparency into the fees they pay. Today, most limited partnership agreements state the general methodologies behind the carry calculation, leaving only limited room for interpretation from GP finance departments.

One area often left ambiguous is the compounding model used in determining the preferred return hurdle. When it comes to this calculation, a significant portion of firms choose simplicity over optimization. In doing so, they run the risk of inflating preferred returns, delaying carry payments to deal team members, and even lowering total carry payouts. To explore how these inefficiencies arise, we’ll compare two commonly used European waterfall models and measure the impact of their different preferred return interpretations on a hypothetical fund.

The easy option – fixed date compounding

In an effort to simplify the preferred return calculation, many firms compound all their fund’s outstanding capital on a fixed calendar date each year. Maintaining a fixed date waterfall model tends to reduce complexity compared to other approaches, but the simplicity comes at a cost.

A fixed date approach means that few (if any) of the capital calls accrue preferred re- turn for a full 12-month period before the accrued amounts compound and begin accruing interest of their own. Not only does early compounding always result in a higher hurdle compared to more precise methods, it also results in a larger true hurdle than the rate stated in the LPA.

The fixed date model’s impact on marginally profitable funds (ie, funds that liquidate with an IRR close to the hurdle rate) can be significant. Keeping the hurdle low in an under-performing fund may prove the difference between partners receiving a small amount of carry or none at all. Fixed date compounding is particularly damaging in these scenarios. Funds with substantial returns also feel the impact of sub-optimal compounding, albeit to a lesser extent than their low-IRR counterparts. Funds capable of repaying the preferred return and satisfying the GP catch-up will be brought into equilibrium (eg, 80 percent LP, 20 percent GP) and will not see an impact to their final carried interest numbers, but the partners in those funds may still feel the impact in the form of time-value loss. A larger hurdle re- quires larger realizations before being paid down, which means partners are often paid on their carry later in the fund’s life.

A worthwhile alternative? Anniversary date compounding

Firms looking to keep their hurdle low may opt for an anniversary date model. This calculates separate preferred return accruals for each capital call and compounds them on their respective anniversary dates. This model introduces two main complexities:

- It can be difficult to maintain separate preferred return accruals for each capital call

- Handling exits resulting in the partial pay down of a commitment may become more Partially returned capital calls require the financial controller to retroactively split the commitment into a returned portion, which no longer accrues preferred return after the exit date, and an unpaid portion that continues to accumulate.

Despite the inherent complexities, an anniversary date waterfall tracks accrued preferred return on outstanding capital more accurately than a fixed date model and will always result in a lower hurdle value. Depending on the size and timing of cash- flows, carry payments to partners may also be available earlier in the fund’s life.

Model Analysis

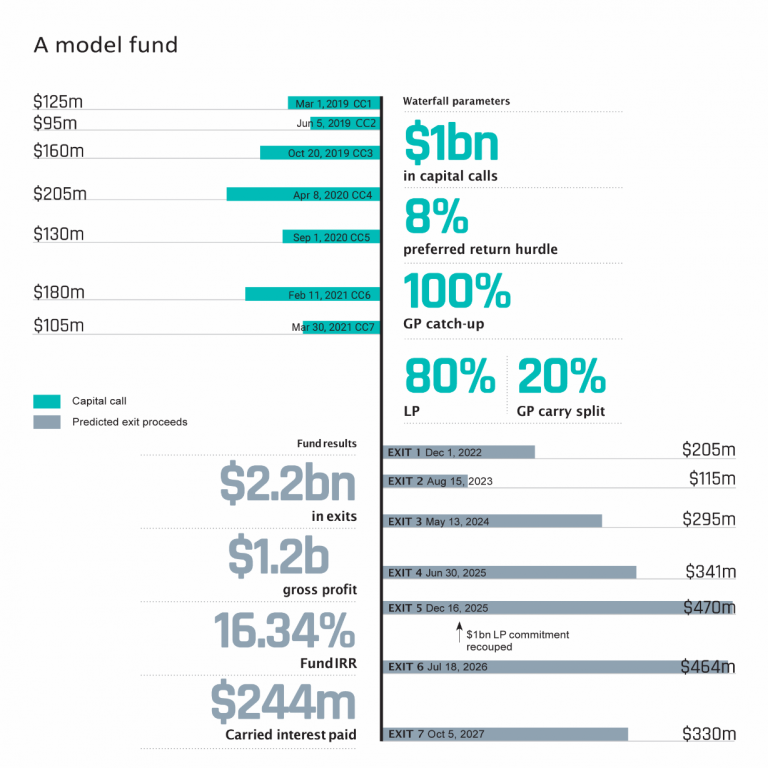

Our model fund achieves a 16.34 percent IRR and realizes gross profits of $1.22 billion, more than enough to repay the preferred return and the GP catch-up for both waterfall models.

The full $1 billion in investor commitments are recouped on the fifth exit on December 16, 2025, which leaves $426 million available to pay down the accrued preferred return and GP catch-up. It is at this point that the two models begin diverging. The preferred returns and the GP catch-up requirements vary greatly between the fixed date and anniversary date waterfalls.

The fixed date waterfall accrues a preferred return more than $44 million larger (11.7 percent) than the anniversary model. A greater portion of the proceeds are then required to satisfy the fixed date hurdle under this model, leaving less than $3 million left over from the fifth exit to put towards the GP catch-up – compared to $47 million using the anniversary date model.

The remaining portions of the GP catch- up is paid off under both models on the sixth exit in July 2026. Having repaid half of the catch-up during the previous exit, the anniversary date model only requires a further $48 million before reaching the carry phase of the waterfall.

But using the fixed date waterfall, the sixth exit results in more than $102 million in outstanding GP catch-up.

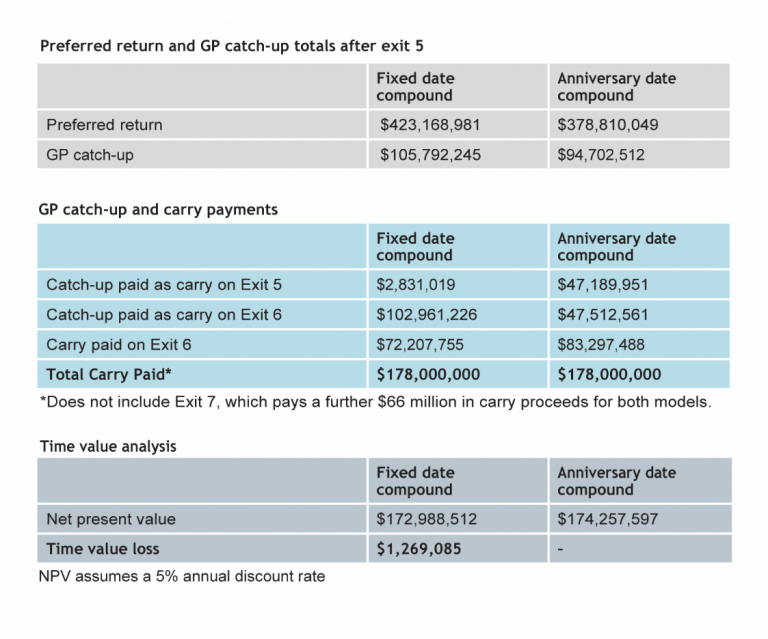

Once both models surpass the GP catch- up and begin splitting proceeds 80/20 in favor of the fund’s LPs, their total perfor- mance fees reach a state of equilibrium. They are then differentiated only by tim- ing disparities in their cashflows. The $44 million difference in payout values after the fifth exit is not resolved for seven months, creating a time value loss on the fixed date proceeds. Discounting the $178 million in carry cashflows from the fifth and sixth exits at a 5 percent annual rate, the two models have different net present values.

Complexity is no longer a barrier to optimization

The fixed date model’s time value loss of nearly $1.3 million is large enough to mer- it consideration from finance departments when establishing waterfall terms for future funds. Even when applying a conservative discount rate equal to that of the current three-month US Treasury rate (2.21 percent at the time of writing), the time value loss is still approximately $570,000.

While it is true that any added GP value comes at the expense of the fund’s LPs, the difference in limited partner IRRs between fixed date and anniversary compound models for this fund was only 0.035 percent, arising due to the fixed date model’s tendency to inflate the preferred return above the LPA’s stated rate. Anniversary date waterfall models more closely align the preferred return calculation with the percentages outlined in the LPA. There is therefore a strong argument for abandoning fixed date waterfalls.

Not only is the reduction in investor IRR negligible, complexity is no longer a limiting factor given the availability of waterfall calculation technology. At a fraction of the cost of an inefficient (or inaccurate) waterfall spreadsheet, digital third-party solutions are now sufficiently advanced to handle the complexities of most waterfalls.

The private equity industry’s search for value should extend to the way firms handle their employee benefits, and the opportunity to generate additional value through optimized waterfalls is an attractive means of doing so. With millions of dollars in lost time value potentially at stake, finance departments should take a closer look at their waterfalls so that they can decide whether the simplicity of the fixed date approach is worth the cost.